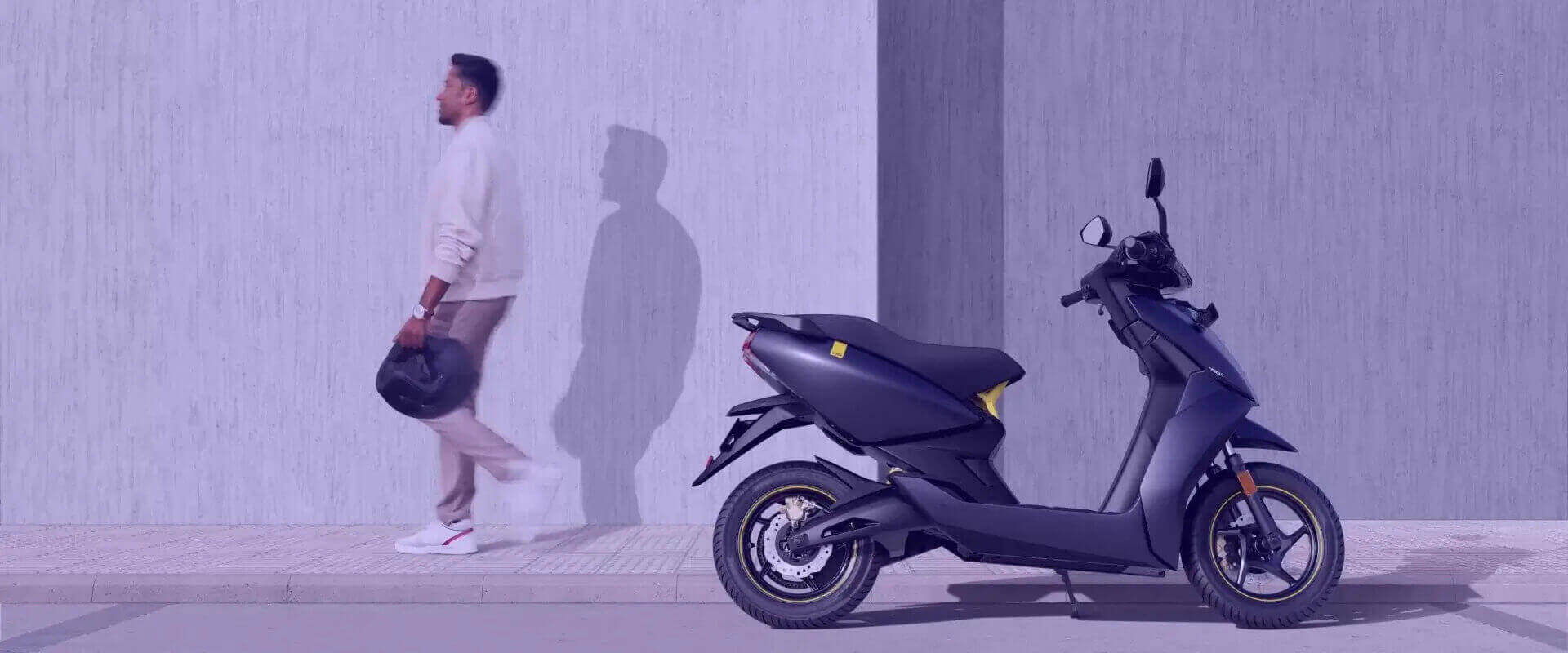

Lease Cars, Bikes and Scooters

Get premium and affordable vehicles at manageable weekly payments, no matter your credit score. return anytime!

Why choose leasie?

Affordable weekly repayment

make your last payment and it's your for a $1

pay out early with no panalties

Repayments to suit your budget

range of vehicles to suit all lifestyles

24/7 roadside assistance

select the vehicle and get approved today

How lease-to-own works with leasie?

select a vehicle

Leasie has partnered up with one of Australia’s largest Dealer Groups to provide you with the most reliable vehicles available on the market today. Every vehicle we offer goes through an extensive 120 point safety check to ensure that it has been regularly serviced, is free of any damage and has a current road worthy certificate.

apply online

Applying for finance doesn't need to be difficult, that's why Leasie has developed an application process that is fast and easy. Our online portal allows you to login from any device, and can be completed within minutes.

set up your payments

Once Leasie has approved your application and you are happy to proceed, you can set up your payments easily by logging into your customer portal. Once your payment details have been added and the set up fee has been paid, you will be contacted by your account manager within 24 hours to organise collection of your vehicle.

ride/drive away

Now to the fun part. Once your delivery date has been confirmed, you are ready to go. On the day of delivery your account manager will show you through the vehicle to ensure that you are satisfied with its overall condition.

ongoing support

Once you have collected your vehicle, your account manager will be available for any ongoing support required. Including updating your personal details, rescheduling repayments, requesting payout figures, plus much more.

testimonials

The team at Leasie were very helpful. I wasn't sure if I was going to get approved, but they made the entire process easy and I was able to pick the bike up within 48 hours.

christine alverez

I wanted a scooter to use for UberEats. I applied with Leasie, and was approved the same day. They also provided the documents to upload in my UberEats account.

pablo manso

I needed a bike urgently to get to and from work. I applied for finance with a few lenders and got declinned due to my Visa. Leasie gave me a chance, and I really appreciate it. A++

don george

FAQ

How much does it cost to lease a vehicle through LEASIE?

Our prices are started on each vehicle and our weekly repayments are designed with the shortest period possible in mind, so that you can own-it within 24 months. At Leasie, we mostly cater to credit-excluded customers that cannot get funding through traditional lenders due to having VISA restrictions, ABN holders wanting a vehicle for delivery purposes, or customers just wanting a flexible way of purchasing a vehicle.

What would disqualify me from leasing a vehicle with Leasie?

All applicants must be at least 18 years of age, be earning atleast $2,500 per month and hold a valid driver's license. The applicant must not be currently bankrupt or experiencing hardship. It is crucial that you only apply if you can afford to take on the additonal repayment, on top of your existing expenses.

When will I own the vehicle?

Once you make the final payment, you will own the vehicle. You can also decide to purchase it at any time during the lease term. If you would like to pay out your lease early, just send us an email to contact@leasie.com.au stating that you wish to pay your lease out early, and we will then assist you with the final payment process so you can finalise your lease. When all required payments have been made, we'll transfer the title of ownership to you. Then, you'll own the vehicle unencumbered. Leasie retains full ownership and title on all of its leasing vehicles until the final payment is made.

Can I use the vehicle for food deliveries?

Our vehicles are designed to be used for delivery purposes. Whether you want to deliver through UberEats, Menulog, or Amazon, we have you covered. You can earn money with our leasing vehicles as long as you follow our terms and conditions noted at https://www.leasie.com.au/terms-conditions.html.

Will I need to buy insurance for the vehicle?

Yes, you are required to obtain insurance for the vehicle while also noting Leasie as an interested party. Insurance will help reduce any financial burden in the case of theft, loss, or damage. You’re free to use any registered insurance agency of your choice. Should you already hold a policy on another vehicle, you can also choose to extend that insurance policy to cover the new vehicle. If you need any further assistance on our vehicle insurance requirements, or recommendations on insurance options available to you. Please reach out and we will assist where possible.

How often should I service the vehicle?

You’re expected to service the vehicle as per the manufacturers requirements. The service intervals can be found either in the log books provided or by visting the individual manufacturers website. You’re required to perform service checks and make necessary repairs on the vehicle where necessary. Regular servicing ensures that the vehicle remains reliable and in the best condition possible.

Can someone else drive the vehicle?

Yes, you can allow a third party to use the car. However, the person must be covered on your insurance policy. Also, your contract restricts you from giving someone access to the vehicle in exchange for money.

Can I own the vehicle early?

You can own your vehicle any time! Inform us when you’re ready to purchase your vehicle and we will provide you a current payout letter. Once all instalments have been made, the vehcile will be transferred into your name.

Do I need an Australian drivers licence?

No, However it is a requirement to have a customer reference number (CRN). This helps to identify you when using transport and main roads online services. The customer reference number enables Leasie to transfer the registration of the vehicle into your name. If you need any further assistance on applying for a customer reference number, please reach out and we will assist where possible.

Who pays for Tolls and Fines?

Once the vehicle is registered in your name, all tolls and fines will be issued to your nominated address held with the Department of Transport and Main roads. To avoid any unnecessary fees, please make sure you keep the Department of Transport updated with your current postal address at all times, and have a valid Linkt Account so that your tolls are paid without added aministration fees.